With Us Buying a Home Never Felt So Easy

Home purchasing made painless

Buying a home can feel overwhelming. Mutual of Omaha Mortgage can help you make an informed and smart decision on your home.

-

Know your number

-

Shop with Confidence

-

Make Homeownership a reality

-

Learn the products

-

Understand the process

-

Check out best practices and tips

-

Historically low interest rates

-

Streamlined process

-

Easy to use digital mortgage app

See What Our Customers Have to Say

Jamie DeWolf in HARRISON TOWNSHIP, MI

On October 11, 2024Tony was Great to work with, awesome communication, no matter what day or time, he always managed to take my call if I needed anything.

Jayaprathap Surendranath in Frisco, TX

On September 28, 2024Pat and team were very proactive and transparent throughout the process. They went out of their way to make the process smoother and explain to me all the steps and options

Patricia Ajemian in ASHLAND, OR

On September 05, 2024Guy was always there for me every step of the way. He would communicate immediately with me when I had questions or a problem cropped up, no matter if it was during business hours or after hours. He was able to resolve serious issues quickly and we were able to close our house quickly within the 30 days period. He also was present at the signing. When he wasn't available he has excellent help with his assistant Carrie Dynge. I would absolutely recommend Guy to any one who wants a mortgage broker. He was also able to get me a much lower interest rate than I expected. I hope to use Guy again if I ever need to buy another house in the future. I will recommend him to people I know who might be looking for a mortgage agent and to. realtors in the Rogue Valley area.

Douglas Butler in Kennewick, WA

On September 05, 2024Sebastian and Sarah were totally on top of everything and kept in constant communication with me. They made the process easy and it flowed very smoothly!

Janice Celia Mumford in Canton, GA

On September 02, 2024My husband and I are more grateful to you than you know. It was a pleasure working with you and your staff, and we are pleased to have you as our loan officer. You outperform others I have worked with in the past. My husband and I received daily updates on the loan progress. Kevin is detail-oriented and very knowledgeable about actions that need to be taken to keep the loan process moving. It was a pleasure working with you. Thank you for the actions you took to make everything happen.

Michael Andrew Weiser in Lynchburg, VA

On August 30, 2024Patrick was very responsive and personable throughout the whole entire process and ensured we had what we needed and cared about me. If anything was ever due that was urgent he would politely give me a heads up and explain what this upcoming next step in process would be and why it was critical for timing.

Shivtej Tata in Tewksbury, MA

On August 29, 2024From start to finish, Mike was extremely communicative throughout the entire process. He thoroughly explained everything about the mortgage process, including approvals, pre-approvals, and other checks. He consistently kept me updated on the rates and offered valuable advice, but never pressured me into choosing a particular rate. Mike was also quick to provide any details I needed. Overall, the whole experience was smooth and comfortable, with no unexpected surprises.

Andrea Michele Hubbard in Covington, GA

On August 27, 2024I was amazed at the level of customer service that Kelvin and his team provided! There was not a day that went by that someone did not contact me to give status updates or words on encouragement to be patient the process is working! They assisted when necessary and fought when required, I was a challenge and this team and I won!! Thank you very much for making a difference in my life!!

Michelle Wilhite in Anderson, SC

On August 22, 2024Working with Matt made my job as a realtor feel like a pleasant walk in the park! I can honestly say I didn't feel stressed at all, my clients were so happy the entire process, and his communication was always on point! I can't wait to do many more closings with him in the future!

Lynn M Adgett in Fort Mohave, AZ

On August 20, 2024Sebastian, found the best loan for us when others failed. He was always available by phone or email and guiding us through the process. I would say one of the smoothest transactions we have had with a mortgage company and we have refinanced many times on many other homes. We are thankful to have found Sebastian and this loan to make our lives easier. Everything was exactly as promised!

77728 Reviews

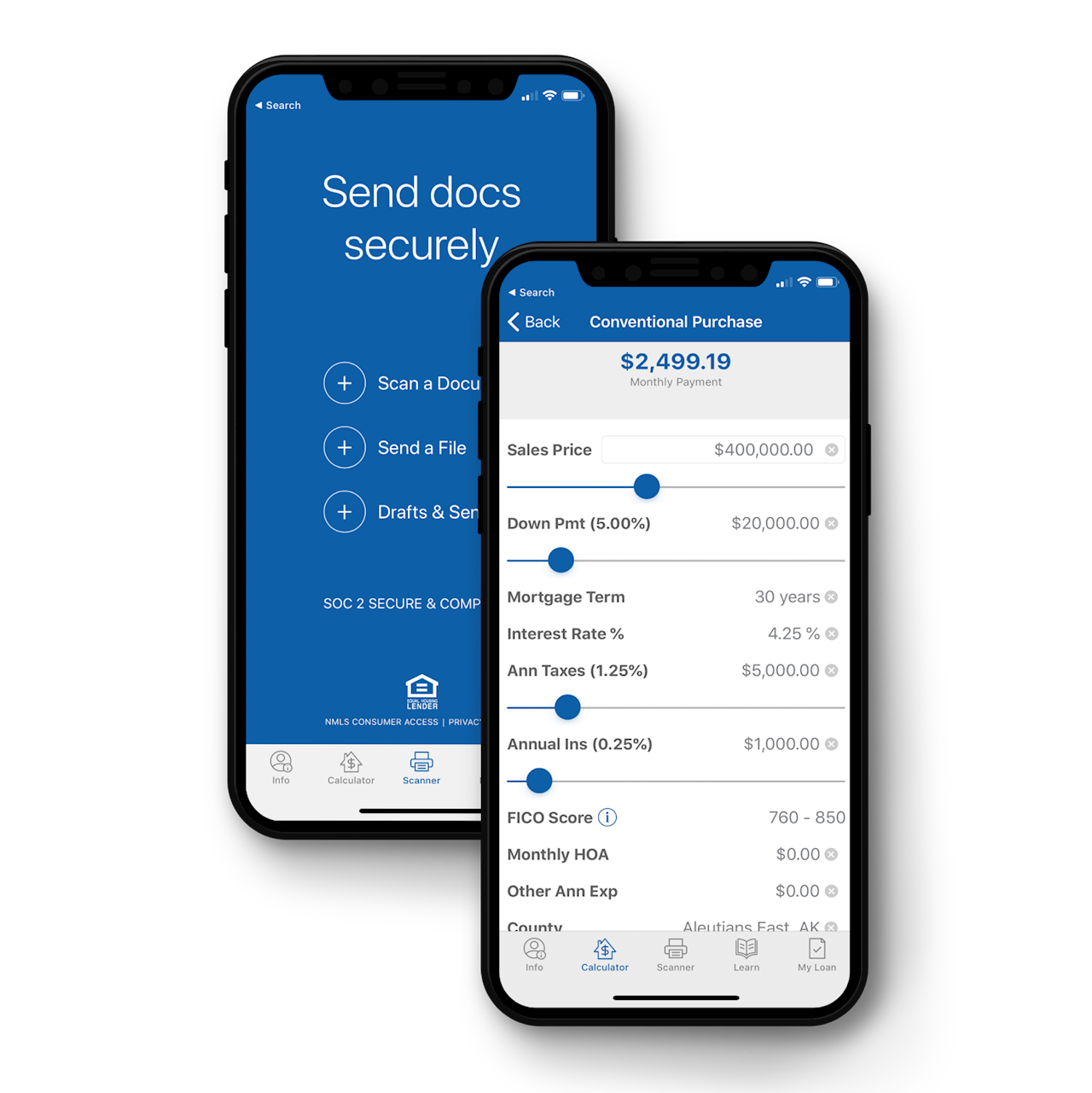

Mortgage Tools at Your Fingertips

With the Mutual of Omaha Mortgage App, you’ll have all your mortgage tools in one place and move the process forward with a tap.

- Apply at anytime, from anywhere

- Quickly access calculator tools to estimate your mortgage payments

- Securely scan and send loan documents with ease

- Check your loan status 24/7

- Direct access to your loan officer

Mutual of Omaha Mortgage is proud to be part of a company with a rich history.

Founded in 1909, Mutual of Omaha serves over 4.6 million individual product customers and 36,000 employer groups.

For a century – through countless historical events – Mutual of Omaha has been there to keep promises to its customers. Inspired by hometown values and a commitment to being responsible and caring for each other, Mutual of Omaha Mortgage continues that legacy. Our mission is to provide home financing solutions that help our customers, and back our services with operational excellence at every level. Today, as the nation grapples with new financial realities, Mutual of Omaha Mortgage is strong, stable, secure, and ready to meet your mortgage and financial needs.

Home purchase tips from the experts.

Get preapproved or start your home loan appication

Mortgage questions. Simple answers.

Mutual of Omaha Mortgage can prequalify you based on your answers to questions about your credit, income and employment. We will suggest a prequalification for the lending product based on our discussion: a suggested loan product, interest rate estimate and down payment requirement before submitting a formal application. Get Started!

Although the 30-year fixed-rate mortgage is most often recognized by prospective buyers, it's not the only option available. The 15-year mortgage product can offer unique benefits and advantages that may help a prospective homebuyer achieve their goals by best matching their financial needs.

The 15-year fixed-rate mortgage is a great option for homebuyers with the right financial profile, who have the ability to make higher payments each month. A 15-year fixed-rate mortgage may allow these homebuyers to pay off their mortgage sooner than a 30-year mortgage and enjoy lower interest rates. Read More

Buying a home is typically the largest purchase a consumer will make in their lifetime. Committing to a mortgage is often a long term agreement. It's important that prospective homebuyers take time to carefully establish how much house they can afford and what percentage of income should go towards their monthly mortgage payment. To determine how much money should be allocated to a monthly mortgage payment, it's imperative for potential homebuyers to have a full understanding of the process, and identify what percentage of income a mortgage payment should be in order to comfortably and confidently afford monthly payments. Read More

The more you can pay up front, the less you'll pay in interest over time. If you are purchasing a home, aim for at least a 20% down payment. Anything less than that will require Private Mortgage Insurance (PMI). If 20% is not possible, put down at least 10%, otherwise you'll get hit with an even higher interest rates and fees. So if you're buying a $300,000 house, you should save up at least $30,000-$60,000 as a down payment. Get Started Today!

The time has come. You’re ready to make the transition from renter to homeowner, but aren’t sure where to start.

With so many types of homes and loan options, crossing the finishing line and closing on your dream home can seem like a daunting task. Take a look at our top 10 tips to make your life as easy as possible during the home buying process. Read More

The more you can pay up front, the less you'll pay in interest over time. If you're purchasing a home, aim for at least a 20% down payment. Anything less than that will require Private Mortgage Insurance (PMI). If 20% is not possible, put down at least 10%, otherwise you'll get hit with an even higher interest rates and fees. So if you're buying a $300,000 house, you should save up at least $30,000-$60,000 as a down payment.