As we move into the final stretch of 2025, there’s reason for both homebuyers and real estate professionals to feel encouraged. The Federal Reserve has begun cutting interest rates, inflation is showing signs of cooling, and the housing market continues to adjust. While change is never without complexity, the evolving economic landscape is creating new possibilities for buyers, sellers, and those helping them navigate it all. Here’s where things stand now:

Economic Shifts: Signs of a Soft Landing

The U.S. economy continues to show signs of moderation. August’s inflation reading came in at 2.9%—a positive sign after months of elevated figures—and the labor market is beginning to cool without a sharp rise in unemployment. For buyers, this means economic uncertainty is easing. For agents, it’s a signal that market confidence could begin to rebound heading into the end of the year.

Federal Reserve: Rate Cuts Underway

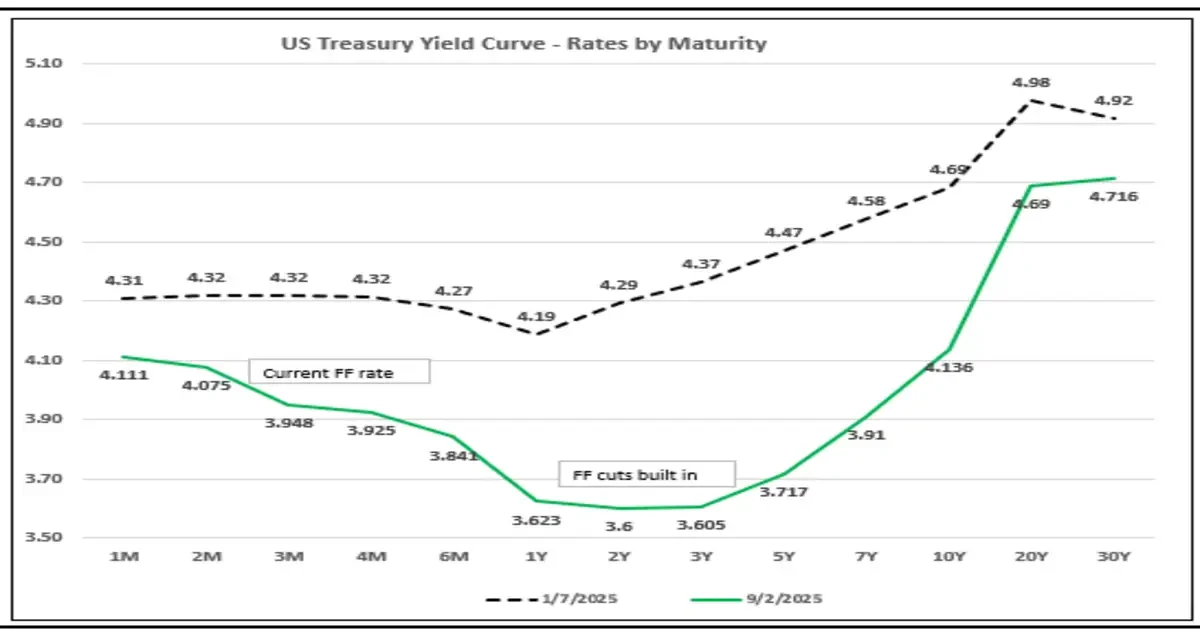

In a welcome move, the Federal Reserve issued a 25 basis point rate cut in September, the first in nearly a year. Another reduction is expected at the Fed’s next meeting later this month. These decisions mark a turning point in monetary policy, aimed at fostering affordability and spurring economic momentum. While future rate moves will depend on inflation and jobs data, the current trajectory is encouraging for long-term borrowing conditions.

Mortgage Rates: A Bit Higher, But with Relief on the Horizon

Despite the Fed’s shift, average 30-year mortgage rates recently ticked up to around 6.25%—a modest increase from earlier lows. This disconnect is not unusual, as mortgage rates are influenced more by the bond market and inflation expectations than Fed actions alone. Still, the general outlook suggests that rate relief is on the way, particularly for buyers who stay prepared and ready to act.

Buyer & Seller Impact: Timing Matters

For buyers, current conditions present a mixed opportunity: while rates are slightly elevated, fewer bidding wars and more room to negotiate can work in their favor. Sellers still benefit from low resale inventory and motivated buyers, but pricing and presentation remain critical. A well-timed listing or purchase, paired with smart financing strategies, can still lead to a win-win this fall.

Agent Impact: Opportunity to Lead with Insight

For agents, this is a key moment to guide clients with confidence. The evolving market requires clear communication about what today’s numbers really mean, how to leverage lender programs, and when to make a move. Mutual of Omaha Mortgage is here to support you with real-time updates, creative lending solutions, and a team dedicated to helping you turn market knowledge into client success.