Brought to you by Mutual of Omaha Mortgage

Home Prices Are Steady—Not Soaring, Not Sliding

You might still hear headlines about rising home prices, but when we look closer, the growth has leveled off. According to the latest data, home prices were up 3.9% compared to a year ago—but most of that increase happened last spring. Since last summer, prices have been holding steady.

What this means for you: If you’re a buyer, this is a much more balanced market than we’ve seen in recent years. And for sellers, smart pricing and solid marketing are more important than ever.

The Economy Is Slowing, and That Might Help Rates

Economic growth unexpectedly dipped in the first quarter of the year—GDP came in at -0.3%, when economists had expected a small gain. That doesn’t mean we’re in a recession, but it’s a sign that things are cooling off.

Why it matters: Slower growth and easing inflation make it more likely that the Federal Reserve could lower interest rates later this year—which could create more opportunity for buyers.

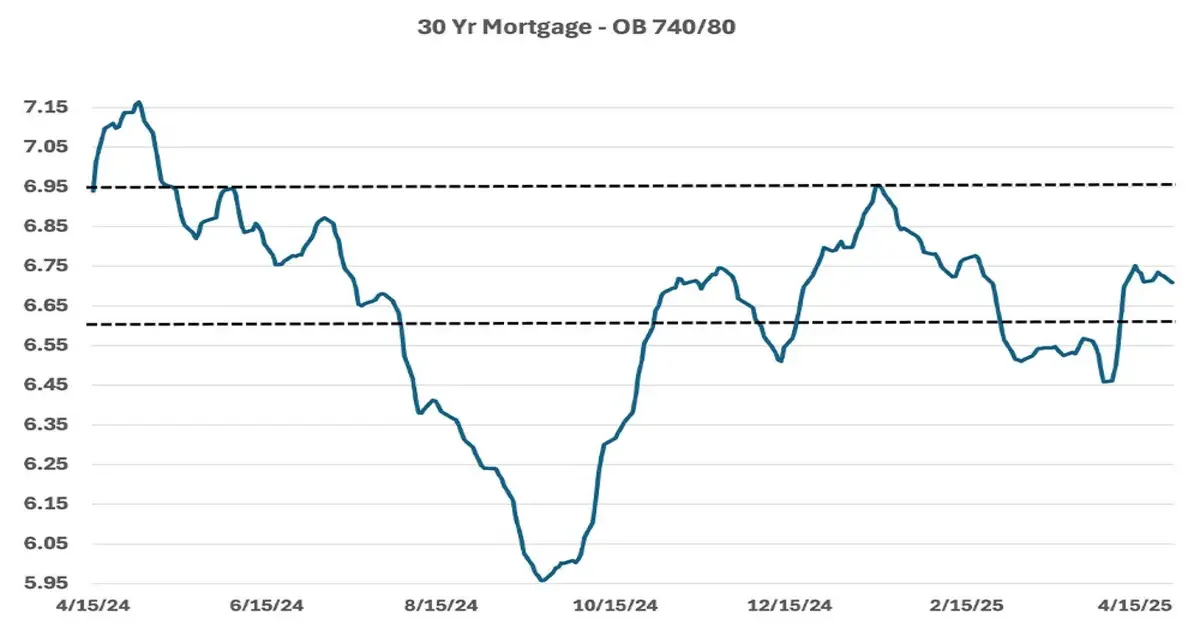

Mortgage Rates: Still in a Stable Zone

Mortgage rates climbed a bit earlier this month but have since eased slightly. Even with some short-term movement, we’re still in the same range we’ve been in for over a year—between about 6.60% and 6.90%. That kind of consistency is unusual in today’s market and gives buyers a window of predictability.

For buyers: If you’re shopping, don’t panic over day-to-day rate changes. We can talk about lock options, buydowns, or refinancing later if rates fall further.

For agents: Reassure your clients that while the headlines may sound dramatic, the market itself is holding steady.

Is the Fed Going to Cut Rates?

Not just yet. The Fed is expected to hold steady at its upcoming May meeting, but many experts still believe we’ll see a few rate cuts before the end of the year. The next few months of data—on jobs, prices, and spending—will be critical.

What This Means for You

We’re in a more balanced market. Prices are stable, rates are predictable, and the economy is cooling—setting the stage for opportunity, especially as we head into the summer season.

Whether you’re a first-time buyer, a move-up client, or a real estate agent helping clients through these shifts, Mutual of Omaha Mortgage is here to guide you with clarity, care, and expert support.