As summer winds down, the housing market is entering a stretch of greater rate stability—but with some uncertainty still ahead. With inflation still in play, but rate cut expectations rising, this is a moment to pay attention. Whether you’re buying, selling, or guiding someone through either, here’s what to know about where things stand now.

Economic Shifts: Mixed Signals, Growing Questions

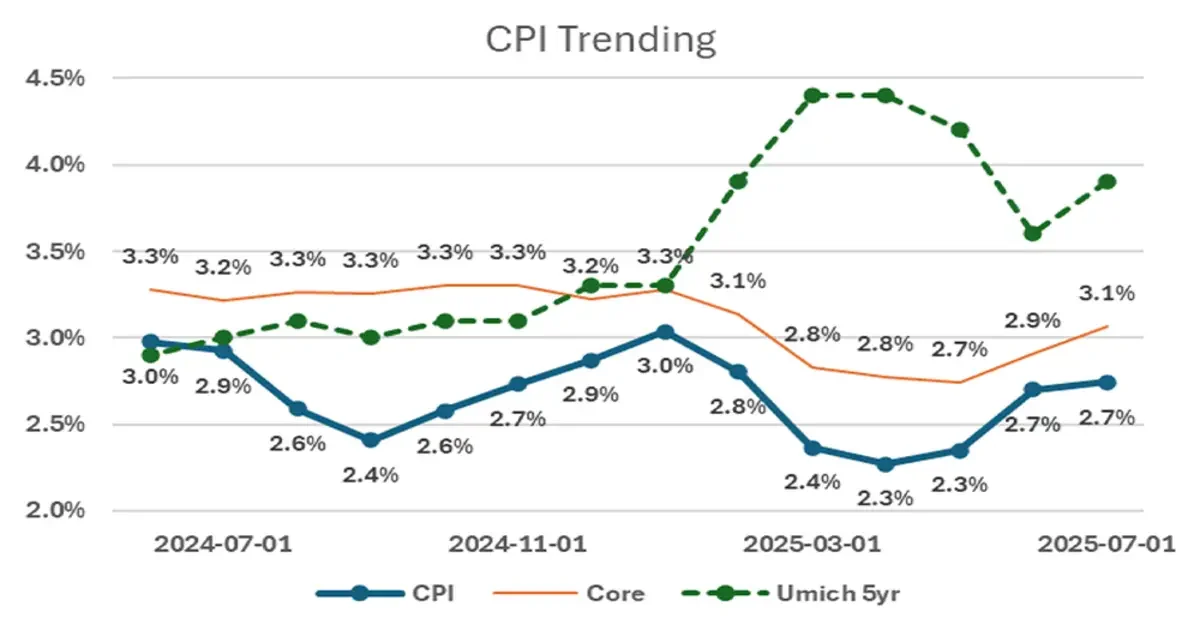

Inflation remains slightly elevated—July’s CPI landed at 2.7%, and wholesale prices jumped more than expected. At the same time, economic growth has cooled and labor market trends are softening. The market is sending mixed signals, but the good news is: mortgage rate volatility is down, and market watchers are optimistic that rate relief is on the horizon.

Federal Reserve: A Potential Turning Point

Markets are currently pricing in an 83% chance of a Fed rate cut at the next meeting. While higher inflation complicates things, slowing job growth may push the Fed to act. The big moment to watch: Fed Chair Jerome Powell’s Jackson Hole speech this week—which may offer insight into what’s next for rates through the end of the year.

Mortgage Rates: At 4-Month Lows and Holding

30-year fixed mortgage rates have settled between 6.45% and 6.60%—their lowest levels since spring. Bond market volatility is down, and mortgage rate spreads are tightening. For clients and agents alike, this consistency makes it easier to plan, quote, and lock when the timing is right.

Buyer & Seller Impact: Opportunities with Strategy

Buyers are benefiting from stable rates and slightly more negotiating room. Sellers should stay realistic with pricing—but many are still finding success, especially when homes are well-prepared and strategically marketed. For both, it’s a time to lean on expert guidance and explore tailored financing solutions to make the most of the current window.

Agent Impact: Inform, Strategize, Act

With rate stability and possible Fed movement ahead, agents have a real opportunity to re-engage clients. Now is the time to check in, run updated affordability scenarios, and bring in lending partners early to help buyers and sellers act decisively when conditions shift.