The housing market is experiencing some important shifts as summer winds down. Slower job growth, moderating home prices, and a recent drop in mortgage rates are creating new opportunities for buyers, sellers, and the professionals who serve them. Here’s what’s happening now—and what it could mean for you.

Economic Shifts: Slower Growth, More Balance

The U.S. economy grew 3.0% in Q2 after a small decline in Q1, but momentum is slowing. Job growth has cooled significantly, with large downward revisions to prior months, and home prices have dipped for three consecutive months—something we’ve seen only a handful of times in the past 25 years. Annual price gains are now at their slowest pace since mid-2023, and housing supply is gradually increasing. This combination could mean more options for buyers and a shift toward a more balanced market.

Federal Reserve: Rate Cuts on the Horizon?

Weaker labor data and slower growth have increased the odds of a Federal Reserve rate cut at the September meeting to 91%, with multiple cuts possible by the end of the year. For both buyers and sellers, any cuts could improve affordability, expand buyer pools, and make financing more attractive.

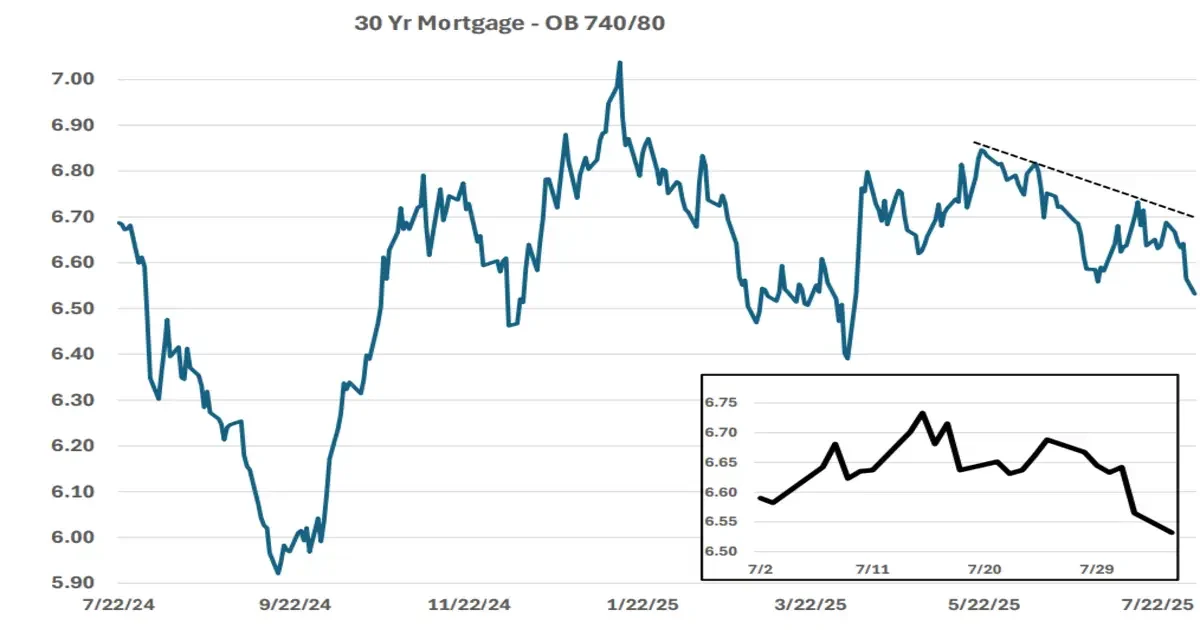

Mortgage Rates: First Significant Drop in Months

Following softer jobs data, the 10-year Treasury yield fell to its lowest level since April, bringing 30-year fixed mortgage rates down into the 6.50–6.65% range. While rates remain high by historical standards, this is a meaningful improvement and could be the opening many buyers have been waiting for.

Buyer & Seller Impact: Opportunities Emerging

Lower rates can increase purchasing power, drawing some buyers back into the market. For sellers, competitive pricing and good presentation are still essential, but lower borrowing costs can spark renewed interest—especially for well-priced homes in desirable areas.

Agent Impact: Time to Reconnect and Re-Engage

For agents, now is the moment to re-engage with your pipeline. Share the rate news, offer updated affordability scenarios, and encourage both buyers and sellers to explore their options before the market shifts again. Partnering closely with a lender can help turn curiosity into action.