As we move through the summer market, many are wondering what’s next for rates, the economy, and the housing market overall. While interest rates remain elevated, inflation is cooling, and both buyers and sellers are adjusting to a new sense of normal. Here’s what we’re watching and what it means for you.

Economic Shifts: Signs of Stability

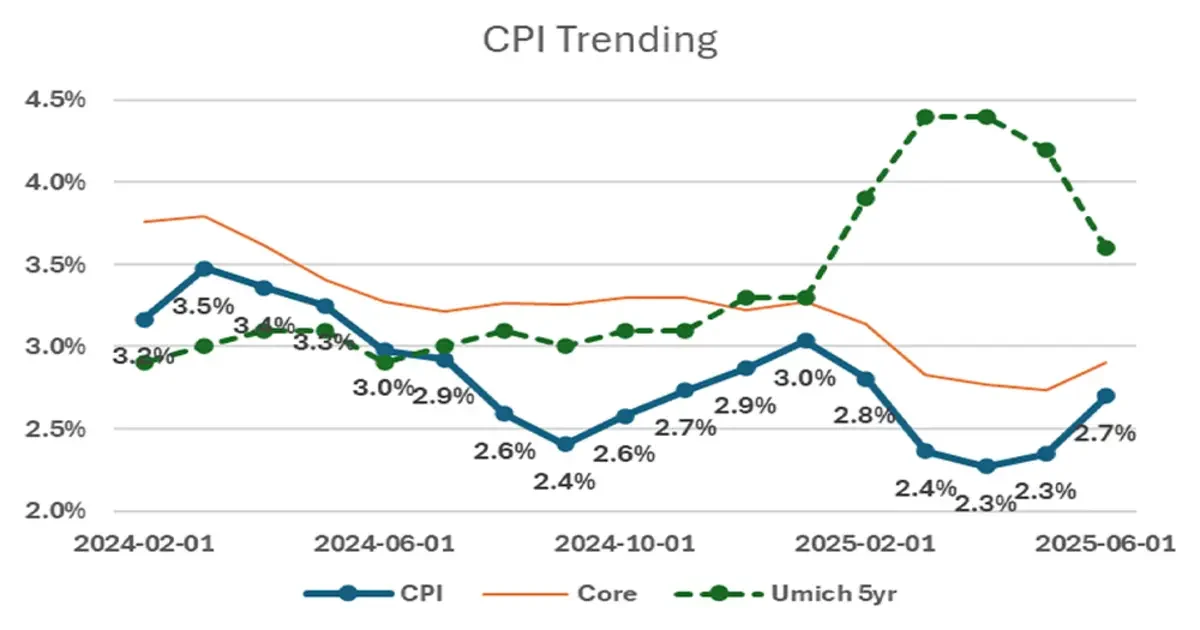

June’s inflation came in at 2.7% year-over-year, showing steady improvement from recent highs. Consumer expectations around inflation are trending lower too, a positive sign that price pressures are easing. Though the broader economy is still finding its footing, this gradual shift is helping restore confidence—for homebuyers, sellers, and real estate professionals alike.

Federal Reserve: Waiting on a Cut

The Federal Reserve is expected to hold rates steady at its upcoming July meeting. However, markets are increasingly optimistic that we’ll see the first rate cut by September. Over the next 18 months, forecasters expect multiple cuts—potentially lowering borrowing costs and improving affordability. For now, the Fed is closely watching economic trends before making its next move.

Mortgage Rates: High, But Holding

30-year fixed mortgage rates have remained relatively stable over the past several weeks, ranging between 6.55% and 6.75%. While these levels are still high by historic standards, this consistency is giving buyers time to adjust and move forward with confidence. For those ready to act, options like buydowns and extended rate locks are helping create more flexibility.

Buyer & Seller Impact: Mindset Shift in Motion

Today’s buyers are more budget-conscious and value-driven, but they haven’t left the market. Many are adjusting expectations, embracing rate strategies, and leaning on trusted professionals. Sellers are also recalibrating—realizing that proper pricing and preparation matter more than ever in keeping deals moving.

Agent Impact: Guidance Is Everything

In this environment, your role as an advisor is more important than ever. With rate uncertainty and affordability still top-of-mind, clients are looking to their agents and lenders for clarity, education, and smart strategies. Agents who partner with strong mortgage professionals and bring proactive solutions to the table are winning trust—and closing more deals.