Inflation Slows, But Uncertainty Persists

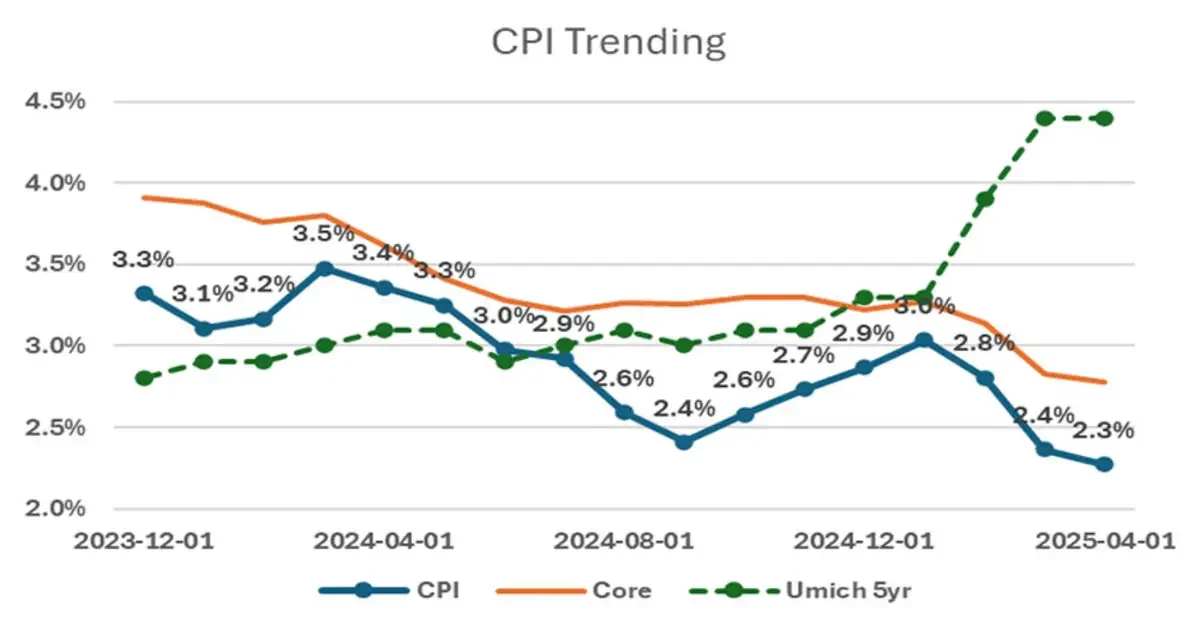

As we move further into 2025, the U.S. economy continues to show mixed signals, particularly in the area of inflation. The latest Consumer Price Index (CPI) data for April reveals a 2.3% decrease, marking a third consecutive month of declining inflation, the lowest in over four years. This trend offers some relief, especially for consumers concerned about rising costs.

However, despite this progress, there is still a significant level of uncertainty. Inflation expectations remain elevated, with the University of Michigan’s survey showing that consumers expect inflation to average 4.4% over the next five years. This suggests a continued skepticism among the public, even though the headline CPI has softened.

What’s Driving This Uncertainty?

Inflation may appear to be under control, but the outlook remains cautious. A key factor contributing to the ongoing uncertainty is the “base effect”—the comparison between today’s inflation data and lower levels from the previous year. This means that, even with relatively stable prices, inflation could rise slightly in the coming months as we compare current numbers to the low points of 2024.

On top of this, the Federal Reserve is caught between two key priorities: curbing inflation and preventing an economic slowdown. The Fed has signaled that it remains uncertain about whether the economic risks of rising inflation or a potential downturn are more pressing. As a result, the outlook for future interest rates is still unclear, adding another layer of uncertainty to the broader economic landscape.

Impact on Mortgage Rates and Housing Market

Currently, the 10-year U.S. Treasury yield is hovering around 4.5%, marking the highest level since February 2025. This, in turn, has kept mortgage rates relatively high, currently near 6.5%. These higher rates are a key consideration for prospective homebuyers, especially those looking at larger loan amounts or higher-priced properties.

While rising mortgage rates may limit some buyers, others may be encouraged to explore more affordable housing options or refinance at fixed rates to lock in lower monthly payments. Homebuyers will need to be strategic and work with mortgage professionals to better understand their financing options in this economic environment.

Guiding Homebuyers Through Uncertainty

For mortgage professionals, the key takeaway is clear: stay informed and be proactive in educating homebuyers. With inflation slowing, but the potential for further rate hikes in the coming months, your clients may feel hesitant about their purchasing power. Providing clear, timely information and guiding them through the complexities of mortgage financing can help alleviate concerns and ensure they make informed decisions.

Stay tuned for more updates as the economy continues to evolve. Let’s navigate these changes together, ensuring that we continue to serve our clients with the expertise and confidence they need to make smart homebuying decisions.