Market Conditions, Interest Rates, and the Road Ahead

As we move into the second half of 2025, the housing market remains in a state of flux, with several key factors influencing both buyers and sellers. Whether you’re a homebuyer navigating high interest rates or a real estate agent helping your clients make informed decisions, understanding the current economic landscape is essential for success. Here’s a closer look at what’s happening in the market and how Mutual of Omaha Mortgage can help you navigate these challenges.

Economic Shifts and Sales Volume

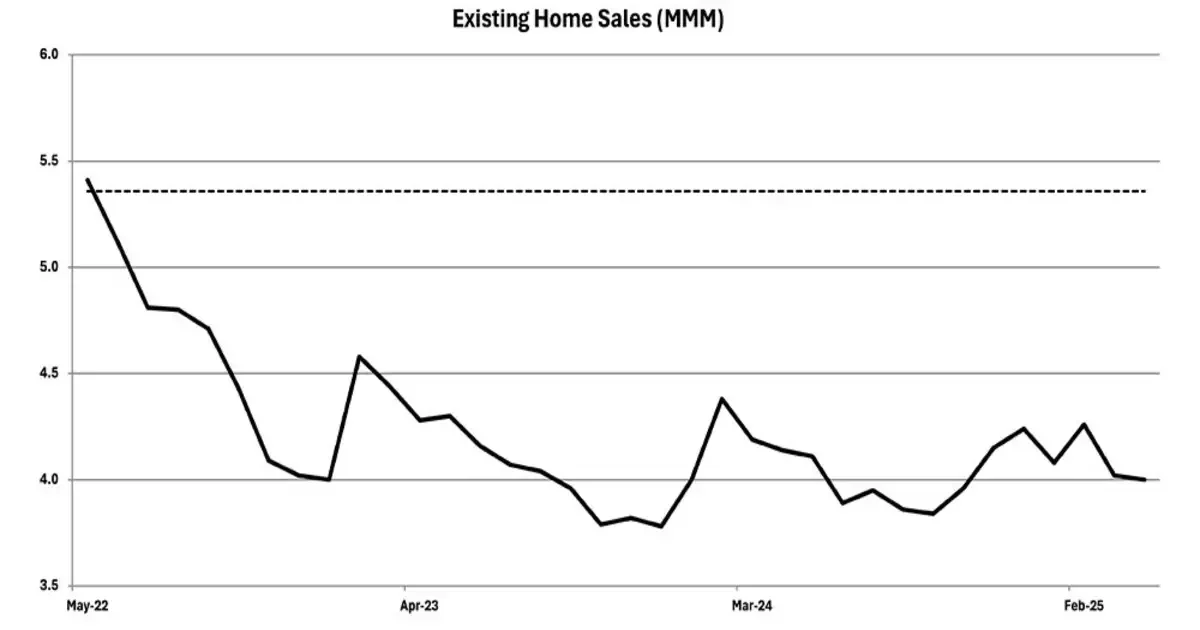

Existing home sales have been slower than usual, with an annualized pace of just 4.0 million units in April. This marks a 3.4% decline compared to last year and is approximately 25% below long-term monthly averages. High home prices and elevated mortgage rates, combined with the “lock-in effect” (homeowners reluctant to sell due to low mortgage rates), are continuing to limit both buyer demand and seller inventory.

While these factors create an unusually tight market for buyers, they also offer an opportunity for new home construction. With fewer resale homes available, many buyers are turning to new builds. As a mortgage partner, we can help make new construction homes more affordable, offering flexible loan products and customized solutions.

Federal Reserve and Interest Rate Impact

The Federal Reserve continues to keep interest rates elevated in response to ongoing inflation concerns. While the short-term yield curve has stabilized, long-term uncertainty remains, with the 10-year U.S. Treasury yield now above 4.5%, and the 30-year mortgage rate reaching over 5%. These high rates are significantly impacting affordability, making it more difficult for many buyers to enter the market.

For real estate agents and homebuyers, this means higher monthly mortgage payments and a tighter budget for purchasing a home. However, despite these challenges, there are still ways to make homeownership possible, especially with creative mortgage solutions designed to fit buyers’ needs in this high-rate environment.

What’s Driving Market Jitters?

A variety of macroeconomic concerns are keeping the bond market on edge, which could further affect interest rates in the coming months. These factors include:

- Tariff Uncertainty: Ongoing trade policies and their impact on construction materials and costs.

- Fiscal Worries: Concerns over long-term government deficits and their potential impact on the broader economy.

- Auction Anxiety: Weak demand in recent Treasury auctions has raised concerns about liquidity and borrowing conditions.

- Global Concerns: Instability in markets such as Japan’s bond market could ripple into U.S. rates.

These concerns are contributing to an overall cautious market, which impacts affordability and buyer confidence. Homebuyers and real estate professionals alike will need to stay informed on these developments as they can influence future rates and market stability.

How This Affects Homebuyers and Real Estate Agents

For homebuyers, the primary challenge continues to be affordability. While the tight market can lead to higher demand for new homes, rising mortgage rates make it difficult for many buyers to secure affordable financing. Whether you’re buying your first home or upgrading to a new one, understanding your financing options is crucial in this environment.

For real estate agents, guiding clients through this market requires an understanding of the financial landscape. Educating buyers on temporary buydowns, adjustable-rate mortgages, down payment assistance programs, and other creative financing options can make a significant difference in helping them afford their dream home. As a trusted mortgage partner, we’re here to work alongside you, providing the tools and resources necessary to close deals in a high-rate environment.