As we head into the holiday season, recent economic data and a more stable rate environment are bringing a welcome sense of balance to the housing market. Buyers are cautiously optimistic, sellers are recalibrating, and real estate agents are finding renewed opportunity to guide their clients through more predictable terrain.

Economic Shifts: Signs of Stability After a Slower Summer

Recent indicators show that the U.S. economy is settling into a more measured pace. Job growth is moderating, consumer spending is softening slightly, and inflation is gradually easing—all signs that the overheated pace of the last few years is cooling. For consumers, this means fewer economic surprises and a chance to plan with greater confidence. For agents, this sets the stage for buyers who may have been sidelined to re-enter the conversation.

Federal Reserve: Staying Put…for Now

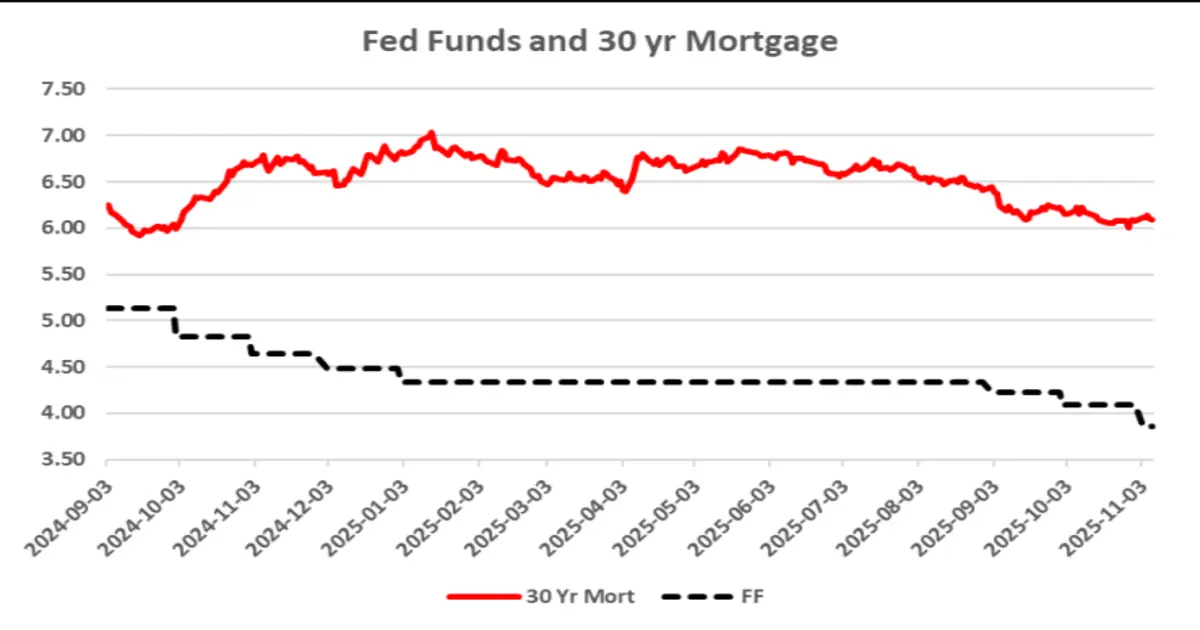

At its November meeting, the Federal Reserve held interest rates steady for a second consecutive time, signaling that they may have reached the peak of this rate-hiking cycle. While no official rate cuts were announced, the Fed’s tone has shifted toward patience. Many analysts now anticipate the first cut could arrive in early 2026 if inflation continues to cooperate. This “wait-and-see” approach gives the housing market room to breathe and may reduce rate volatility moving forward.

Mortgage Rates: Holding Firm, With Modest Relief

Mortgage rates have edged down slightly over the past few weeks, offering some breathing room to buyers. As of mid-November, rates are hovering around 6.2–6.4% for 30-year fixed loans, down from recent highs near 7%. While still higher than in past years, these rates are more palatable for consumers who are adjusting their expectations—and potentially revisiting their homebuying plans.

Buyer and Seller Impact: Rebalancing Creates Opportunity

For buyers, the combination of lower rates and slightly less competition is creating a more approachable market. Some sellers are adjusting pricing to meet buyers where they are, especially in markets where homes linger longer than expected. Sellers who are strategic with pricing and presentation are still seeing strong interest—particularly in move-in-ready homes. And for consumers considering new construction, many builders are offering financing incentives that help close the affordability gap.

Agent Impact: Time to Reconnect and Realign

For real estate professionals, this is a powerful moment to reach out to prospective clients who paused their plans earlier this year. Many are now revisiting their home search or considering a move in early 2026. With fewer economic unknowns and mortgage rates leveling off, agents can bring data-backed reassurance to their client conversations. It’s also an ideal time to collaborate closely with your lending partners to provide creative solutions, from temporary rate buydowns to pre-approval refreshes.