With the Federal Reserve officially cutting interest rates by 0.25% today—their first rate cut since December—the landscape for homebuyers, sellers, and agents is shifting. As mortgage rates respond and economic signals continue to evolve, this fall could present new opportunities for those ready to act. Here’s what you need to know about the latest trends.

Economic Shifts: Signs of Balance as Inflation and Jobs Recalibrate

August inflation came in at 2.9%, its highest level since January—an unwelcome sign for those hoping price pressures would ease. But the bigger surprise came from the labor market: recent government data revisions showed that over 900,000 fewer jobs were created than initially believed. This rebalancing of inflation and employment is what led the Fed to cut rates today, indicating a more supportive stance for economic growth going forward.

Federal Reserve: First Cut Confirmed, More May Follow

The Fed officially lowered its benchmark interest rate today by 25 basis points, now targeting a range of 4.00% to 4.25%. The move reflects growing concerns about labor market softness, and more cuts could follow in the months ahead. That said, mortgage rates don’t always move in sync with the Fed—how markets interpret the Fed’s tone on inflation will play a major role in shaping what happens next.

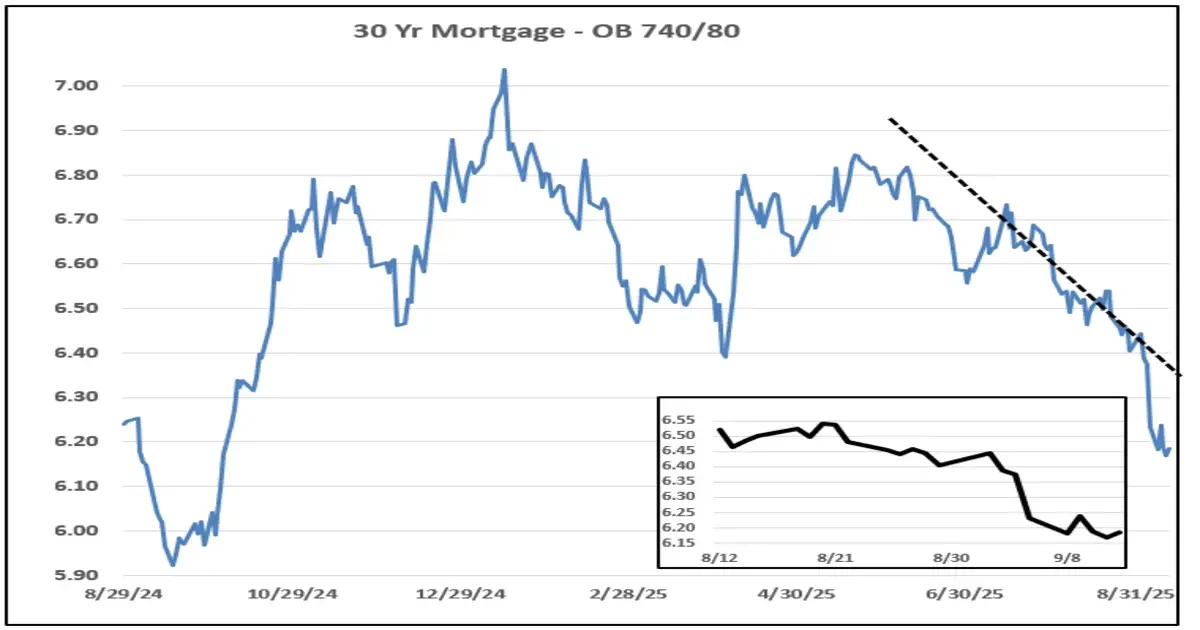

Mortgage Rates: Lowest Levels in Over a Year

Mortgage rates have fallen roughly 0.40% since peaking in May and are now sitting at their lowest levels in more than 12 months. With bond market volatility easing and mortgage-Treasury spreads tightening, this could be a prime opportunity for buyers who’ve been waiting for a more affordable entry point. Whether this trend continues may depend on how inflation behaves and how the bond market digests the Fed’s long-term strategy.

Buyer & Seller Impact: A More Active Fall Market

With borrowing costs easing and economic uncertainty beginning to stabilize, both buyers and sellers are becoming more confident. For buyers, this means improved monthly payments and better negotiating leverage. For sellers, a more rate-sensitive pool of buyers may reenter the market—especially for homes priced competitively and marketed with strong financing options.

Agent Impact: Now’s the Time to Reconnect

Agents: now is a perfect moment to re-engage your pipeline. Rate relief has arrived, and clients may be more open to taking the next step with updated affordability numbers in hand. Be ready with pre-approval options, rate lock strategies, and insights into how today’s Fed action may shape the rest of 2025. Trusted guidance will continue to be your greatest advantage.