As the fall season approaches, shifting economic conditions are creating both challenges and opportunities in the housing market. Mortgage rates have eased from their summer highs, the Federal Reserve is weighing its next move, and buyers and sellers alike are recalibrating. Here’s what you need to know right now.

Economic Outlook: A Mixed Picture

The economy continues to send uneven signals. Job growth has slowed significantly, and markets are watching closely for the latest jobs and inflation reports—both of which will influence the Federal Reserve’s September 17th decision. At the same time, questions about tariffs and government funding add another layer of uncertainty. Still, housing trends suggest the market is moving toward a healthier balance, with pricing and activity stabilizing after months of volatility.

Federal Reserve: Rate Decision Approaching

The odds of a Fed rate cut in September are currently near 92%. If it happens, borrowing costs could become more favorable for consumers in the months ahead. However, it’s worth noting that in past cycles, cuts to short-term rates have not always translated into lower long-term mortgage rates right away. Agents and buyers alike should prepare for some volatility as markets adjust.

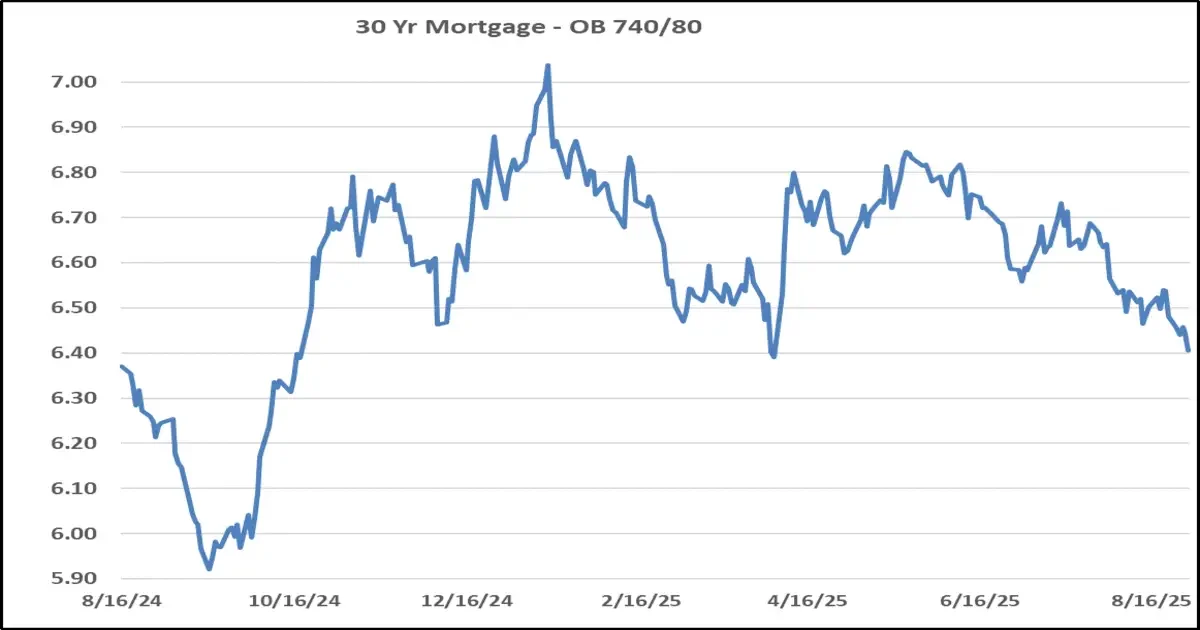

Mortgage Rates: A Much-Needed Dip

Mortgage rates have fallen to their lowest levels since October 2024—about 0.4% below the highs reached this spring. The 30-year fixed is now ranging from 6.40% to 6.60%. While these levels are still higher than many would like, the recent dip gives buyers an improved opportunity to secure financing and sellers a chance to attract more interest.

Buyer & Seller Impact: A Window to Move

For buyers, lower rates can translate into more manageable payments and greater purchasing power. For sellers, this shift could mean renewed traffic and stronger offers—provided homes are priced competitively and presented well. In a market that’s still affordability-driven, strategy and timing make all the difference.

Agent Impact: The Time to Re-Engage

For real estate professionals, this is the moment to reconnect with your pipeline. Clients may not know that rates have eased, or how this affects their affordability. Providing updated payment scenarios, highlighting financing strategies such as rate locks and buydowns, and partnering with a trusted lender can help clients act with confidence.

Let’s Talk Strategy

Whether you’re buying your first home, planning a move, or guiding clients through today’s changing market, Mutual of Omaha Mortgage is here to help. With flexible loan solutions and a commitment to clarity, we’ll help you make the most of today’s opportunities.